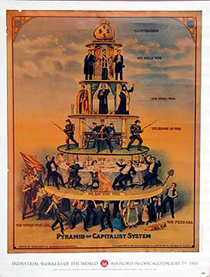

When even the Republican Real Estate industry acknowledges the gaps between haves and have nots ...

... you know it's getting worse.

Widening income gap to wreak havoc on consumer confidence

Although the overall level of consumer confidence was unchanged in July, it masked a growing divergence between the rich and the poor, according to a survey released today.

The Index of Consumer Sentiment was 84.7 in the July 2006 survey, nearly identical with the 84.9 in June, but well below the 96.5 recorded in July 2005, according to the University of Michigan's Survey of Consumers. Current economic conditions were judged slightly less favorably, largely due to the impact of gas prices, although both current and expected economic conditions were judged much less favorably than a year ago.

"Higher prices have driven a wedge between upper- and lower-income households that now extends well beyond their personal financial situation," according to Richard Curtin, director of the survey. Comparing households in the lower one-third of the income distribution with those in the top third, the difference in the overall measure of consumer sentiment was larger than any time since the early 1980s, according to the survey.

"Households in the bottom third of the income distribution held significantly more negative views about their own financial prospects as well as a more negative outlook for employment and economic growth," Curtin said.

The Index of Consumer Expectations, a closely watched component of the Index of Leading Economic Indicators, rose slightly to 72.5 in July from 72 in June, but significantly below the 85.5 recorded in July 2005. In comparison, the Current Economic Conditions Index fell to 103.5 in July, down from 105 in June, and was significantly below the 113.5 in June 2005.

The gap between income groups is quite different than anything observed in the prior half century, the survey found. In the past, the gap grew in size immediately following a recession, as upper-income households were quicker to recognize and benefit from an improving economy. "The current situation is exactly the opposite, as the gap is now due to lower-income households voicing much less favorable economic expectations when the economy is closer to the expansion's peak," Curtin noted.

A worsening financial situation was reported twice as frequently among the bottom third compared with the top third of the income distribution, with complaints about high prices voiced nearly three times as frequently. "When asked about their financial prospects for the year ahead, half of all families in the lowest third of the income distribution expected declines in their inflation-adjusted incomes, twice as frequently as among families with incomes in the top third," Curtin said.

Buying plans for homes, vehicles and large household durable goods were all lower in the July 2006 survey than a year ago. Home-buying plans posted the largest loss, falling to a 15-year low. Although vehicle buying plans increased slightly in July due to aggressive end-of-model-year discounts, they remain significantly below the year-earlier levels.

The latest data on consumer confidence is consistent with a growth rate in real consumer spending that averages about 2.5 percent during the next four quarters. "The growth rate in spending will slow over the next four quarters, and be quite uneven across products that appeal to different income groups," said Curtin.

Source: Inman Real Estate News

0 Comments:

Post a Comment

<< Home